Ahh, the age-old question of whether to buy or rent? Many people have been confused by this subject, and with good cause. One of the most significant financial decisions you’ll ever make is whether to buy or rent a property. It matters how you live as much as where you plan to live. Each of the options has an own set of advantages and disadvantages. Which course is best for you, then? This book will explain the benefits and drawbacks of each option, assisting you in making the right choice for your circumstances, whether you’re a seasoned renter considering a move into ownership or a first-time homebuyer considering your alternatives.

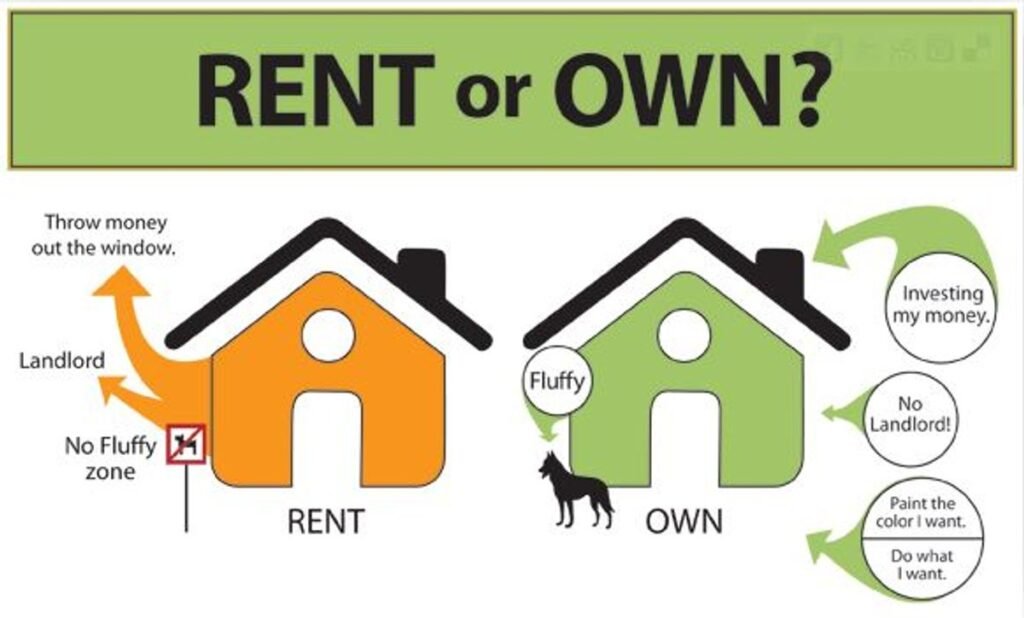

Advantages of Owning a Home

- Equity Building: One of the biggest perks of homeownership is building equity. Each mortgage payment chips away at your loan balance, increasing your ownership stake in the property. Over time, this can be a significant financial asset.

- Stability: Owning a home provides long-term stability. You won’t have to worry about rent hikes or lease renewals. This stability is especially beneficial for families looking to settle in one place.

- Tax Benefits: Homeowners can often deduct mortgage interest and property taxes from their taxable income, potentially leading to significant savings come tax season.

- Creative Freedom: When you own your home, you can renovate, paint, and decorate to your heart’s content without needing landlord approval. This freedom allows you to truly make the space your own.

- Investment Potential: Real estate can be a solid long-term investment. As property values increase over time, you can potentially sell your home for a profit.

Disadvantages of Owning a Home

- High Upfront Costs: Buying a home requires a substantial upfront investment, including a down payment, closing costs, and moving expenses. These costs can be a barrier for many potential homeowners.

- Maintenance Responsibilities: Homeowners are responsible for all maintenance and repairs, which can be both time-consuming and costly. There’s no landlord to call when something breaks down.

- Market Risk: Real estate markets can be unpredictable. While property values generally increase over time, there’s always a risk that your home’s value could decrease, particularly in the short term.

- Less Flexibility: Owning a home ties you to a specific location. If you need to move for work or personal reasons, selling a home can be a lengthy and complex process.

Advantages of Renting a Home

- Lower Upfront Costs: Renting typically requires a lower upfront investment compared to buying. You’ll need to cover a security deposit and possibly the first month’s rent, but these costs are much lower than a down payment on a home.

- Flexibility: Renting offers greater flexibility, making it easier to relocate for work or personal reasons. You’re not tied down to a mortgage, and lease terms can be as short as a few months to a year.

- No Maintenance Worries: When you rent, the landlord is usually responsible for maintenance and repairs. This can save you time, money, and hassle.

- Predictable Expenses: Renting provides predictable monthly expenses, as rent payments are fixed for the duration of the lease. This predictability can make budgeting easier.

Disadvantages of Renting a Home

1.No Equity Building

When you rent, your monthly payments don’t build any equity. Essentially, the money you spend on rent is gone, with no financial return.

2.Rent Increases:

Rent can increase periodically, sometimes significantly, making long-term financial planning more difficult.

3.Limited Control

Renters have limited control over their living space. Want to make changes or renovations? You’ll need the landlord’s approval.

4.Lack of Stability

Leases end, and landlords can decide not to renew, forcing you to move out and find a new place to live.

Which is Right for You?

So, which option is right for you: owning or renting? The answer depends on a variety of factors, including your financial health, lifestyle preferences, and long-term goals.

Financial Health

- Stability and Income: If you have a stable income and a good credit score, buying a home could be a viable option. It allows you to invest in an asset that could appreciate over time. However, if your financial situation is uncertain or you’re just starting out, renting might be the safer bet. It requires less upfront money and provides greater flexibility.

- Savings: Do you have enough savings for a down payment and other costs associated with buying a home? If not, renting allows you to save up while maintaining a place to live.

Lifestyle Preferences

- Flexibility: Do you enjoy moving around or might need to relocate for work? Renting offers the flexibility to move without the hassle of selling a property.

- Stability: If you’re looking to settle down and create a long-term home for your family, owning might provide the stability you seek.

Long-Term Goals

- Investment: If building equity and having a potential investment are important to you, owning a home makes sense.

- Freedom and Control: If customizing your living space and having control over your property are priorities, homeownership is the way to go.

Personal Circumstances

- Family Needs: Consider the needs of your family. If you need more space, a yard, or proximity to certain schools, owning might offer more options.

- Future Plans: Think about your future plans. Are you planning to stay in one place for a long time? Or are you unsure where life might take you?

Frequently asked Questions

1.Is owning a home always better than renting?

Not necessarily. It depends on your financial situation, lifestyle, and long-term goals. For some, renting offers flexibility and lower upfront costs, while owning can be a good investment for others.

2.What are the hidden costs of owning a home?

Beyond the mortgage, homeowners need to budget for property taxes, insurance, maintenance, and repairs. These costs can add up and should be considered when deciding to buy.

3.How can I decide if I’m financially ready to buy a home?

Evaluate your savings, income stability, credit score, and ability to afford a down payment and ongoing costs. Consulting a financial advisor can help you make an informed decision

4.Can renting be a long-term solution?

Yes, renting can be a long-term solution if it aligns with your lifestyle and financial goals. Many people rent for extended periods due to the flexibility and lower maintenance responsibilities.

Conclusion

Whether to buy or rent a home is a very personal choice that depends on a number of variables, such as your financial status, lifestyle choices, and long-term objectives. Knowing the specific benefits and drawbacks of each option will enable you to make an informed decision. Ultimately, the greatest option for you will depend on what works best for you, whether you prefer the flexibility and less responsibility of renting or the stability and financial potential of buying.

If you are looking any property in gurgaon near